Japan’s recent inflation was hailed as a sign of economic growth but may not be such good news after all.

About eight weeks back, we ran a piece on Japan’s central bank raising the interest rate for the first time in nearly two decades, calling it a turning point and transitioning to a more “normal” economy. Now, we are having second thoughts.

Japan’s economy has long stood apart from other developed economies. Most notably, since the late 1990s, it went through years of stagnation and deflation, an economic crisis referred to as Japan’s “Lost Decade.” For years, Japan had the dubious distinction of being the only advanced economy with near-zero inflation, interest rates, and wage growth. It appeared as if the Japanese economy was emerging from this period of market troughs as prices and wages rose, raising hopes for growth.

A new sense of gloom is descending, and inflation may not be such good news after all. A depreciated yen, costly imports, and higher prices of staple goods like food and fuel have taken a toll on purchasing power. The depreciated yen has also made military equipment imports more costly, impacting Japan’s milestone defence plan.

Background

For decades, Japan has followed an ultra-easy monetary policy, which it evolved to deal with its chronic deflation and near-zero or negative wage growth. This has set it apart from other developed economies. In 2022, prices began to rise due to supply chain pressures caused by the pandemic and Russia’s invasion of Ukraine. This pushed businesses to raise prices, which is significant given that price setting is not the norm in Japan.

These promising signs prompted the BOJ to raise interest rates for the first time in 17 years. Experts hoped that a cycle of increased prices and wages would result in normal economic growth.

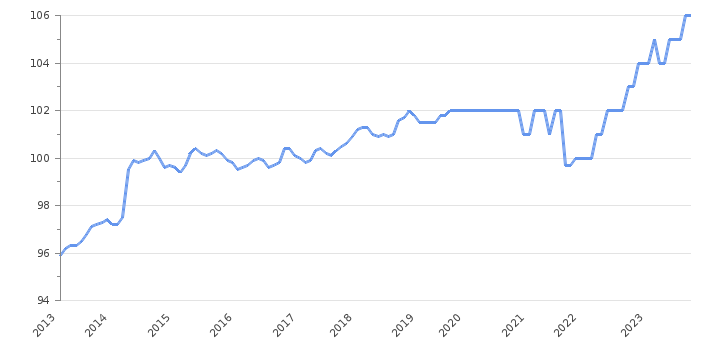

Annual inflation remained above the BOJ’s two per cent target for 18 consecutive months. In February 2024, Japan’s core inflation (excluding volatile food prices) was up by 2.8 per cent year-on-year.

Analysis

There have been certain promising signs. Major Japanese firms like Toyota have reported large profits. Japan’s largest firms have pledged to increase wages by 5.3 per cent. Service inflation in Tokyo went up to 0.9 per cent in June from 0.7 per cent in May, indicating that companies are factoring higher labour costs in their prices.

However, allowing inflation to run its course has caused the yen to depreciate, making imported commodities like food, fuel, and other staple goods more costly. This has affected purchasing power, pushing consumers to cut back on spending.

Many attribute the weak consumption to the long-running loose monetary policy featuring zero or negative interest rates that was designed to target stagnant prices and also devalue the currency to keep exports competitive. While this policy benefitted big exporting companies, it affected consumers’ purchasing power, real wages, and smaller businesses. Consumer demand is low, and so are savings. Given this, smaller companies may be unable to pay higher wages despite higher prices.

Most recently, the BOJ has raised interest rates for the second time to around 0.25 per cent from the previous range of 0 per cent to 0.1 per cent, in what seems to be a move towards normalizing the economy. This could help bolster the yen’s value and encourage consumer spending by alleviating concerns about inflation. Yet, critics contend that if the BOJ had raised interest rates sooner, the yen would not have fallen so much, and consumer demand would be stronger. Analysts project inflation will likely stay well above the 2 per cent target in the coming months.

Rapidly rising consumer prices have reached close to the U.S. levels of 3 per cent, hitting 2.8 per cent in June. Household items have displayed price jumps – rice (12.3 per cent), milk (8.9 per cent), potatoes (28 per cent), tomatoes (15.6 per cent) and cabbage (27.6 per cent).

Low wages are not new for Japan. It is one of the features that sets it apart from other Group of Seven (G7) developed countries. However, low costs made it feasible and allowed it to maintain a standard of living on par with advanced economies. Higher inflation now changes this situation.

Wage increases have not kept up with inflation. Real wages have been falling since early 2022. The BOJ is in a conundrum – it may have to raise rates to curb inflation, but it must be careful to avoid stifling the incipient growth and discouraging wage growth.

The weak yen has also impacted Japan’s defence spending. Japan buys a lot of its military equipment from the U.S. in dollars. The ambitious defence budget has witnessed slashed orders and has effectively been cut down by 30 per cent. This affects its plans to fortify its defences against regional threats, which it had unveiled as a part of its national security strategy, in what was a significant pivot from its longstanding policy of military restraint since World War II. The defence budget was based on an exchange rate of 108 yen to the dollar. With the yen falling to 161 to the dollar, the cost of equipment like helicopters, submarines, tanks, and counter-strike technology like US-made Tomahawk missiles has escalated. Even domestically produced military equipment has become more costly because several components are imported, leading to cuts in procurement orders.

One factor that could help the yen recover is the expectation of falling U.S. interest rates due to signs of a slowing economy. This could cause the dollar to weaken against the yen and reduce the inflation of imports. If the U.S. Federal Reserve Bank cuts interest rates and the BOJ raises rates, the yen’s depreciation could be halted. The Federal Reserve has indicated that rate cuts will likely occur soon. Yet, rate hikes by the BOJ are likely to remain small since it is keen to support economic growth driven by wage raises and sustainable inflation.

Assessment

- Japan’s recent inflation is not just a result of higher wages and labour costs but also due to supply chain crunches and costlier imports due to a depreciated yen.

- Though the rising prices were hailed as a sign that the economy was pivoting towards “normal” growth, they may pose a problem in an economy that has so far thrived on low prices, particularly since staple goods have become more costly.

- As global markets continue to yo-yo between crests and troughs, we must wait and watch how this Asian economic powerhouse navigates through its challenges. India, in particular, would keenly observe the progress as Japanese investments make a useful contribution to our rising economy.