From deep dependence on Russian Gas to Gulf LNG and beyond, Europe has overcome the energy security challenge.

The Russian invasion of Ukraine in 2022 triggered an unprecedented energy crisis in Europe, as the continent faced the prospect of gas shortages and blackouts. Under American pressure, lucrative energy deals with Russia, like the $ 11 billion Nord Stream pipeline, came to a shuddering halt. Europe faced the daunting task of finding alternate energy sources even as a record-breaking winter loomed.

The energy crisis following Russia’s invasion of Ukraine exposed vulnerabilities in relying on a single energy supplier. The record-high energy prices impacted the industrial sector, particularly energy-intensive industries like chemicals, steel, and paper.

How Europe, and especially energy-starved nations like Germany, met this challenge is an evolving case study that needs closer examination.

Background

Europe has significantly transformed its energy landscape since Russia began reducing gas supplies in 2021. The need for energy security and decarbonization has driven this shift.

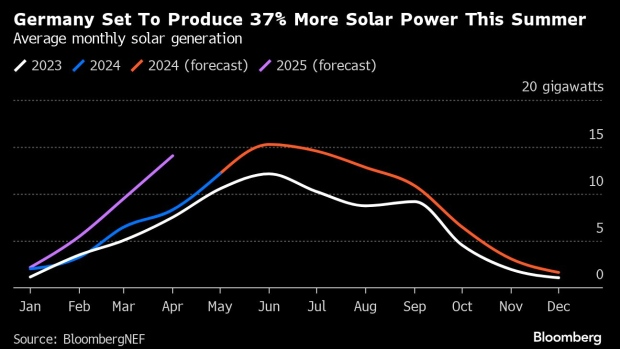

Europe’s response to the energy crisis has been multifaceted, significantly accelerating renewable energy adoption. The EU’s rapid adoption of wind and solar power has been particularly successful. By 2023, these sources accounted for 27% of the bloc’s electricity generation, contributing to a 15.5% reduction in emissions. This progress highlights the EU’s commitment to a greener future and reducing reliance on fossil fuels.

Europe has planned or constructed at least 17 LNG terminals to replace lost Russian gas, enabling the import of LNG and reducing gas prices from their peak in 2022. Germany has demonstrated its ability to surmount challenges with amazing alacrity. It rapidly constructed its first floating gas terminal at Wilhelmshaven, a historic port with a newfound role in energy security. This floating storage regasification unit (FSRU), named Esperanza, became operational in just ten months and has been instrumental in diversifying Germany’s gas supply. The Esperanza, owned by Norway’s Höegh LNG and operated by German energy giant Uniper, now provides a significant portion of Germany’s gas consumption. The FSRU receives liquefied natural gas (LNG), regasifies it, and feeds it into Europe’s extensive pipeline network. This pivotal infrastructure project represents a turning point in Europe’s energy strategy, shifting away from reliance on Russian pipeline gas.

High energy prices have incentivized LNG traders to prioritize deliveries to Europe, ensuring sufficient supply to avoid rationing or blackouts. Developing new infrastructure, such as the Wilhelmshaven LNG terminal, has strengthened the EU’s position as a major LNG importer, with imports accounting for 42 per cent of the bloc’s natural gas supply in 2023.

Analysis

Several factors have contributed to the successful avoidance of a major energy crisis, including unprecedented policy interventions, reduced demand, and favourable weather conditions. Mild winters in recent years have allowed Europe to conserve gas reserves and maintain stable prices. Furthermore, slower economic activity in China, partly due to pandemic-related lockdowns, led to a decline in global LNG demand, further benefiting Europe.

While the shift to LNG provided a short-term solution, it also introduced new challenges. Europe’s increased reliance on LNG exposes it to global gas market volatility and higher import costs than pipeline gas, potentially leading to higher energy costs for consumers and industries.

Transitioning to renewable energy sources has led to a record reduction in emissions and substantial gas savings, but this also poses challenges. Only 2 per cent of Europe’s gas fleet has a scheduled retirement date, raising concerns about the longevity of fossil fuel infrastructure and its compatibility with the bloc’s net-zero emissions target. w

However, the EU’s energy transition is far from complete. The rapid shift towards LNG dependency has raised concerns about the long-term sustainability of this approach. Environmental groups argue that the reliance on LNG could hinder the transition to cleaner energy sources and impede progress towards the goals of the Paris Climate Agreement.

The construction of numerous gas power plants without clear decommissioning plans further complicates the issue. Additionally, the high cost of importing LNG compared to piped gas from Russia could lead to sustained higher energy prices in Europe, potentially impacting industrial competitiveness. Europe’s industrial sector has already felt the consequences of the energy crisis, with many energy-intensive businesses succumbing to record-high energy prices. The chemicals sector experienced a significant decline in production, while other industries like iron and steel, paper and pulp, and non-ferrous metals also suffered substantial losses.

Policymakers are acutely aware of these challenges. They are actively pursuing a diversified energy mix that includes LNG, increased hydrogen production, and a continued expansion of renewable energy. This approach aims to enhance energy security while simultaneously advancing the decarbonization agenda.

The European Union has set ambitious targets for solar and wind power capacity by 2030, highlighting a strong commitment to accelerating the transition to renewable energy. Achieving these goals will necessitate significant investments in infrastructure, technological innovation, and policy frameworks that incentivize the adoption of clean energy.

Nuclear-powered electricity is also considered green, but understandably, there is much apprehension about its adoption, especially in the environment-obsessed EU. According to the World Nuclear Association, 25 per cent of electricity generated in the whole of the EU is produced by 100 nuclear power reactors operated by 12 of the 27 EU member states. Over 50 per cent of the EU’s nuclear electricity is produced only by France. Five non-EU countries (UK, Belarus, Russia, Ukraine and Switzerland) operate 67 nuclear units producing over 30 per cent of the electricity in non-EU Europe. Thus, we see that nuclear generation is a big component of the energy basket in Europe.

Dr Emily Grubert, a prominent energy policy expert, emphasizes the critical nature of the decisions made in Europe’s energy transition. These decisions will have far-reaching impacts on energy security, economic competitiveness, and environmental sustainability across the continent.

EU Commissioner for Energy, Kadri Simson, views Europe’s energy transition as a long-term endeavour requiring sustained effort, collaboration, and innovation. The choices made today will significantly shape the continent’s energy future for generations to come, highlighting the importance of thoughtful and strategic decision-making in this process.

Assessment

- The EU must balance ensuring immediate energy security and achieving long-term decarbonization goals. Navigating this complex landscape will be crucial for shaping its energy future and ensuring sustainability and prosperity for its citizens.

- The EU’s energy transition is complex marked by challenges and uncertainties. However, the bloc’s commitment to renewable energy expansion, diversification of energy sources, and ambitious climate targets provides a roadmap for a more sustainable and resilient energy future.

- The EU’s commitment to reducing emissions by 90 per cent by 2040 requires substantially decreasing fossil fuel consumption. Achieving this goal demands a comprehensive strategy that addresses not only the electricity sector but also heating, transportation, and industry.