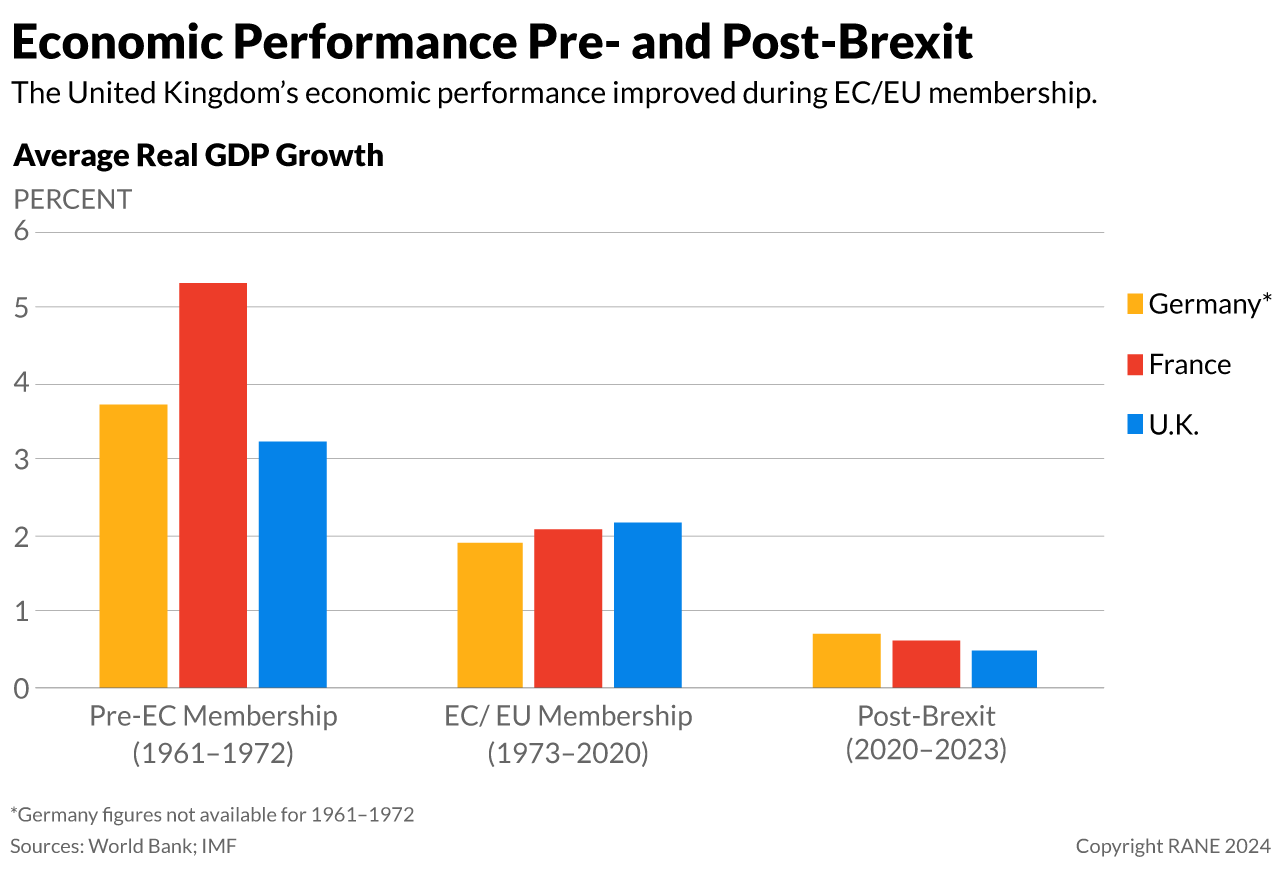

We take a closer look at the UK’s eroding trade balance post-BREXIT.

The withdrawal pangs of BREXIT refuse to fade away as London struggles to get its economy on an even keel.

Brexit’s effects are evident in implementing new border controls years after the official withdrawal from the European Union and the single market. Recently, British customs began physical inspections on imports of plant and animal products following delays in implementing these checks due to concerns about potential disruptions.

These new regulations have sparked frustration among small businesses facing additional fees, with estimates suggesting the cost to UK businesses could reach £330 million a year. This would contribute to a predicted 0.2 per cent increase in food inflation over three years. While the overall economic impact may seem modest, these changes have significant consequences for businesses and consumers.

Two and a half years after the UK formally left the EU, the economic effects of this decision continue to unfold. The 2023 trade data offers the first genuine opportunity to assess the true impact of Brexit following initial disruptions caused by the COVID-19 pandemic and spikes in energy prices.

Background

The post-Brexit trade scenario in the UK presents a complex picture, with contrasting outcomes in its goods and services sectors. The decline in goods trade, down by 10 per cent since 2019, starkly contrasts the 5 per cent average increase seen in other G7 nations. This significant drop emphasizes the challenges the UK’s goods trade faces, likely exacerbated by Brexit-induced trade barriers. Urgent re-evaluation of the UK-EU goods trade relationship appears necessary to address this stagnation and prevent potential disruptions in vital manufacturing supply chains.

Conversely, the UK’s services trade has displayed remarkable resilience, maintaining its strong growth trend predating Brexit. While this is a positive development for the UK economy, accurately gauging the extent of this success remains challenging. Discrepancies between UK-reported data and that of trading partners like the U.S. highlight the complexities in measuring intangible services trade.

Examining mirror data derived from import figures reported by the UK’s trading partners becomes crucial to overcoming these challenges. While not exhaustive, U.S. and EU mirror data supporting the UK’s services trade resilience. However, the lack of comprehensive, detailed data continues to hinder a precise evaluation of the sector’s contribution to overall trade. While the UK’s services trade shows promising growth, the absence of agreed-upon measurement metrics limits a comprehensive understanding of its scale and impact on the broader economy. Standardizing services trade data through collaborative efforts between the UK and its trading partners could enhance policy decisions and leverage the UK’s strengths in this critical sector.

Analysis

The diverging fortunes of the UK’s goods and services sectors create a unique economic profile in the post-Brexit era, carrying significant implications for policy formation and the UK’s future economic trajectory. Understanding the nuanced outcomes and perspectives on this situation is vital.

Firstly, it is crucial to acknowledge that the success of the services trade does not translate into equitable benefits for the entire workforce. The concentration of gains among high-skilled, well-paid professionals within the services sector highlights the potential for increased socioeconomic inequality. Therefore, a holistic trade strategy must go beyond maximizing trade gains. It must proactively address the distributional consequences arising from this trade divergence by aligning with larger goals of economic revitalization that ensure inclusivity and broader opportunity, particularly within the faltering manufacturing sectors. Neglecting this could further exacerbate internal socioeconomic divisions.

The ongoing need to refine the UK-EU goods trade relationship remains a top priority. The decline of the goods sector is closely linked to the newly imposed trade barriers post-Brexit, necessitating an evaluation of the existing trade agreement. Trade policy negotiations to facilitate a smoother flow of goods with the UK’s largest trading partner are essential to prevent the erosion of critical manufacturing supply chains.

While attention focuses on repairing the UK’s trade relationship with the EU, policymakers also recognize the value of harnessing the nation’s dominance in services trade. The UK’s competitive edge suggests a potential for significant gains through innovative trade agreements beyond its traditional European focus. Diversification in this direction could open new markets for UK services expertise, bolstering this key growth sector.

Assessment

- Brexit’s ongoing impact is evident in the UK’s evolving trade landscape, with new barriers like controls on plant and animal products reshaping trading dynamics. Small businesses are grappling with increased bureaucracy and fees, highlighting the tangible effects of these changes. While the long-term economic costs are challenging to quantify, predicted inflationary pressures on food prices demonstrate Brexit’s direct impact on businesses and consumers.

- The UK’s post-Brexit economy requires a trade policy that supports growth in both goods and services. Policymakers must protect the thriving services trade while reviving the struggling goods trade, acknowledging each sector’s unique needs. This entails boosting manufacturing skills and infrastructure, simplifying customs procedures, and pursuing market expansion for services through innovative agreements with non-EU nations, particularly in digital trade and recognition of professional qualifications.

- Experts emphasize that a comprehensive, sector-specific approach is vital for the UK’s long-term economic success post-Brexit. This strategy aims to leverage strengths while addressing weaknesses exposed by leaving the European single market.